Field:

Drivers and Barriers for a Transition to a Sustainable Energy System

– An analysis of the electricity market

The ability to attract and retain skilled labour, business and capital is important for local, regional and national development. Questions such as, “Why are some places more attractive than others?” are becoming increasingly important. Growth Analysis (The Swedish Agency for Growth Policy Analysis) has therefore been tasked with enhancing the knowledge in this area. This article constitutes our first report on this subject, and consists of a research overview of why some places are more attractive than others.

Today, electricity generation, transmission, distribution, and consumption represent trillions of dollars in investment around the world. However, the system is on the brink of a transition. Increasingly cost-competitive renewable energy technology, pressing environmental concerns, and changing customer needs are transforming how we make and use electricity. In Sweden, this transition is being accelerated by the uncertain future of nuclear energy and ambitious policy driving deployment of renewable generation.

The low-carbon transition has made significant progress already – not only in Sweden but in other parts of the world as well. Technological innovation has brought down the cost of renewable energy generation technologies, and carbon pricing regimes are changing incentives in some regions. But there is much more work to be done. A major overhaul of electricity industry design, along with hundreds of billions of dollars in new investment, is needed to make the electricity industry structure fit for the clean and efficient economy of the 21st century. The need to restructure and decarbonise the power industry is arguably the biggest climate change-related challenge facing developed countries.

Public efforts have focused on technological innovation and cost reduction in renewable energy generation, and innovation has brought down the cost of renewable generation technologies. However, innovation is needed across the rest of the system as well to drive accelerating deployment at an acceptable cost to governments and electricity consumers. Current market, regulatory, and business structures are designed to support the fossil fuel-based model of generation; they are not structured to achieve delivery of low-carbon energy at wide scale and low overall system cost. Moving to a low-carbon future requires coordinated innovation in markets, business models, and finance across the electricity sector.

This report outlines challenges and opportunities for low-carbon innovation throughout the electricity industry and presents a possible transition pathway to an efficient, low-carbon system.

Challenges and opportunities in the low-carbon transition

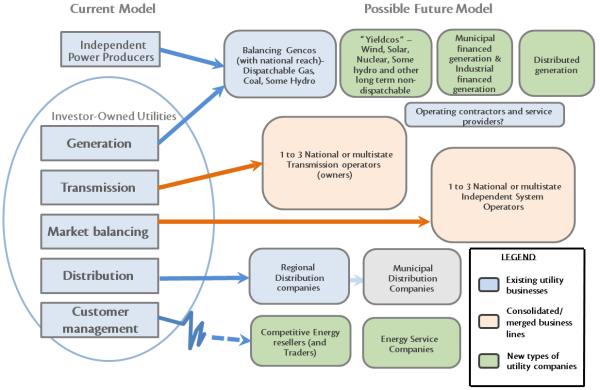

To make a successful transition, each of the five major business segments of the traditional integrated utility model – generation, transmission, market balancing, distribution, and customer management – face major challenges and requirements for new investment and restructuring. Transition to a low-carbon energy system will be impossible, or impossibly expensive, without addressing these challenges. This report focuses in particular on three of these challenges:

Challenge 1: Financing low-carbon generation efficiently

Technological innovation has successfully brought down the cost of power from some renewable energy technologies, but further financial and institutional innovation would allow the electricity system to reap greater benefit from these lower costs. In particular, wind and solar energy projects can provide clean electricity over long periods of time with low operational or technology risks. Well-designed policies take advantage of these low operational and technology risks to provide long-term revenue certainty, which in turn lowers the financial risk associated with wind and solar projects. Nevertheless, these projects pay higher financing costs than are justifiable given their low risk profiles. Our analysis shows that new financing models reflecting the underlying financial characteristics of low-carbon energy projects, as well as the requirements of investors such as pension funds and insurance companies for steady long-term returns, can reduce the cost of renewable energy by up to 20 per cent. These new business models have already begun to emerge in many countries, and policymakers have an important role to play in allowing them to thrive. They include:

- YieldCos: A YieldCo is a listed corporation that owns renewable energy projects whose generation has been bought up-front through a long-term power purchase agreement (PPA). YieldCos provide investors with a steady yield in exchange for an upfront payment. Risk is minimised because projects held by YieldCos have secured long-term revenues through PPAs and have a performance guarantee from the project developer or technology manufacturer.

- Municipal or industrial-owned generation: Industrial or municipal customers can purchase long-term power supplies through part-ownership of generation facilities. German municipalities have been key actors in financing and deploying renewable energy to meet their electricity demand.

- Crowdsourced lending: New platforms permit public investors to invest directly in (portions of) renewable energy projects, making new sources of capital available and lowering financing costs.

Challenge 2: Updating markets and business models to promote efficient investment in flexibility for a low-carbon grid

Meeting flexibility needs in a low-carbon electricity system requires changes in markets and business models for both conventional and low-carbon technologies that can adjust energy supply or demand to maintain a reliable power supply. Regulators will need to modify markets and create new ones to ensure that these resources are deployed cost-effectively to meet system needs, and to create incentives for development and deployment of new low-carbon flexibility resources. Promising pathways in market design and regulation include:

- Expanding energy markets and balancing systems to include additional power generation and balancing resources in the system

- Restructure electricity markets so that marginal-cost-based dispatching is only applied to generators with fuel costs

- Expanding the use of forward capacity markets for trading long-term resources

- Allowing price signals to reflect the true cost of generation will create incentives to invest in flexibility

Challenge 3: Changing the role of electricity customers

Most utility customers are passive users of electricity with little ability or incentive to adjust their usage in response to the needs of the electricity system. But innovative technologies such as smart meters and appliances, distributed generation, and electric vehicles are challenging the traditional passive model. Further innovation in market design and regulation would allow customer generation, storage, and flexible demand to substitute for fossil fuel generation as a grid flexibility resource, and could also help lower barriers to financing long-lasting energy efficiency measures. Customer-side innovations include:

- Public guarantees and risk-sharing facilities to reduce the risk borne by private investors and drive more private investment in energy efficiency

- Allowing demand response, energy efficiency and other demand-side resources to participate in wholesale markets for energy, capacity, and balancing services

- New models for competitive retail electricity providers to package services such as distributed generation, electric vehicles, and efficiency

New business models could bring down costs throughout the system

Based on the three challenges outlined above, we can sketch an outline of a generic future electricity system for the EU or U.S., presented in Figure 0.1. The various elements presented here can work together to mobilise renewable energy investment and incentivise investment in flexibility needed to integrate renewable energy into the grid.

This picture of a low-carbon electricity system includes changes to business models and market structures, building on trends that are already underway. In this report, CPI modelled a scenario that includes restructured electricity markets combined with new business models, in order to illuminate the potential impact of these new models on electricity prices and the economics of renewable and conventional electricity generation. We modelled an electricity market based on power plant and demand data from the state of New York, and separately modelled the impact of moving to new utility business models using data from a large European utility. The results of these modelling exercises are discussed in the following sections.

Changes in electricity markets

Renewable generators have effectively zero marginal costs, so the power they produce is used first, displacing higher marginal cost resources from the supply stack. The resulting decline in electricity prices has made other generators uneconomic, even if they are needed to provide reliability to the grid. The challenge is to create the right incentives to maintain investments in reserve capacity and flexible resources. Removing renewables from the wholesale energy market has been discussed as an option to address this challenge.

We find that a separate market for renewables increases electricity prices but could make both renewables and flexible generation viable. Separating renewables from wholesale energy markets eliminates renewables’ price suppression effect, helping promote investment in flexible generation. In addition, the cost of renewable energy declines, since it is no longer exposed to the volatility of wholesale electricity prices and can therefore obtain financing at lower cost. This changes the risk profile of renewable energy projects and, therefore, investors’ return requirements, helping to lower financing costs. This new structure thus creates a healthy market that can support both reliable supply and low-cost renewable generation.

Changes in business models for generation

Large, utility-scale generation will continue to play a role during a transition to a low-carbon electricity system. However, less of it will be fossil-fuel-based and less of it will provide dispatchable, flexible output. In a future electricity system, a larger share of electricity will come from renewable generators with long-term contracts. The remaining flexible, mainly fossil fuel generators will increasingly be valued more for their flexibility than for their total energy output. New business models will need to reflect these changes.

We find that all the independent entities under the new model are financially viable, with the exception of nuclear due to its historical liabilities. If the assets of a typical European utility were partitioned into potential new businesses, each new business appears to be financially viable, but may benefit from horizontal consolidation by merging with similar entities across Europe. Network and renewable assets are likely to see increased valuation in such a scenario, while fossil fuel assets may be an attractive acquisition target for private equity funds. Nuclear assets, however, are unlikely to be financially viable without government intervention, due to ongoing costs that include provisions for decommissioning and waste disposal.

Policy implications for Sweden

Sweden has already undergone a remarkable transformation from an oil-dependent economy to one that is largely fuelled by low-carbon energy. However, with the uncertain future of nuclear energy in Sweden and ambitious policy measures in place to increase the deployment of renewable energy, the Swedish electricity sector will soon be facing the challenges outlined above. Here, we outline some key questions for future work to assess opportunities to tackle these challenges in the Swedish context.

- How can Sweden update its renewable policies and market structures to reduce the cost of capital-intensive renewable generation? Changes to the Swedish electricity and renewable certificate markets are currently being discussed. It is important that any changes to the system reflect the challenges presented above, especially the issues regarding financing costs and increased incentives for low-carbon grid flexibility.

- Can these changes be optimised to unlock Swedish pension fund financing for renewable generation? With over SEK 1 trillion under management, Swedish pension funds could play a significant role in financing these shifts, if appropriate policy, regulatory, and market structures are in place.

- How can Sweden capitalise on its balancing assets – in particular, its hydropower? Higher penetration of intermittent renewable energy in Sweden and across the EU creates increasing value in flexible grid resources such as large-scale hydroelectric power and energy storage.

- How can Sweden accelerate technology innovation in electrical energy storage and transportation electrification? Sweden has a great deal of knowledge and competence in transport solutions that could be mobilized to innovate also in electric mobility. There are efforts in place, but the results so far have not been on par with the potential. Lessons from successful innovation in this space in the U.S., Japan and South Korea might be helpful in guiding Swedish efforts.

Drivers and Barriers for a Transition to a Sustainable Energy System – An analysis of the electricity market

Serial number: PM 2014:14

Reference number: 2013/164