Field:

Geographical accessibility to pharmaceutical

– An analysis of the deregulation of the pharmacy market – Final Report

Growth Analysis has made an analysis of geographical accessibility to medicines. From available statistics it is clear that the pharmacy reform has led to a large number of new pharmacies being established. In September 2012, there were 1,254 approved pharmacies in Sweden, which is an increase of 330 pharmacies, or approximately 36 percent, since the reform was introduced in 2009.

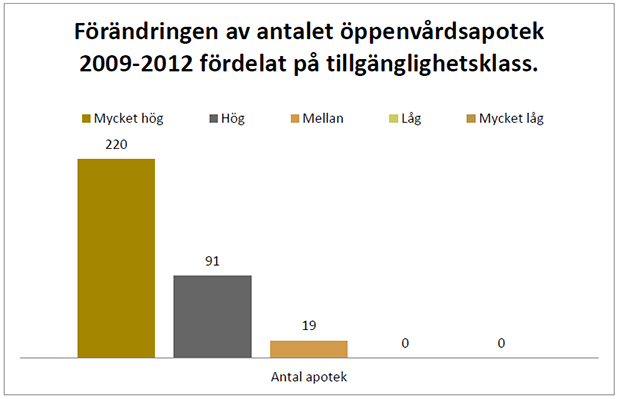

Approximately 300 of the new pharmacies were established in areas with very high accessibility or high accessibility to localities. Most of these, or 220 pharmacies, have been established in areas with very high accessibility to localities. No new pharmacies have been established in areas with low or very low accessibility to localities. In these areas, the number of pharmacies has remained unchanged since the late 1990s.

In general, all new pharmacies have been established in localities with more than 3,000 residents (including a commuting hinterland of 5 minutes). Of the 330 new pharmacies, 324 (98 percent) have been established in such localities.

When the reform was introduced, both purchasers of state pharmacies and Apoteket AB were given responsibility to ensure coverage in sparsely populated areas. The players were obliged through an agreement with the state to continue to run some hundred specified pharmacies in sparsely populated areas for three years without special compensation. The agreements with the pharmacy owners will expire at the beginning of February 2013.

Only a few pharmacies have been established in places where there had previously been no pharmacy at all. Fisksätra, Älmsta, Insjön, Grebbestad, Mellbystrand, Skärhamn and Surte are the places where there had been no pharmacy but where new pharmacies have been opened. New pharmacies have also been opened in several places in the suburbs of larger localities and in city districts in localities that had previously lacked a pharmacy.

Accessibility, measured as proximity to the nearest pharmacy, has improved from a national perspective since the introduction of the pharmacy reform. This improvement in accessibility mainly concerns residents in areas with very high or high accessibility to localities, i.e. those areas where most of the new pharmacies have been opened. In areas with low or very low accessibility to localities, the number of people with more than 30 minutes to the nearest pharmacy is also smaller. This change is explained by demographic factors, i.e. a smaller population in the areas concerned.

The average distance between pharmacies fell in all counties between 2009 and 2012. In large parts of Sweden, however, it is a long way to the second nearest pharmacy and consumers in these areas therefore have no real possibility to choose where to make their purchases. In addition, the structure is vulnerable since travelling time would increase significantly for many people if their nearest pharmacy closed.

77 percent of the population can get to a pharmacy within 5 minutes and 90 percent can reach their nearest pharmacy in less than 10 minutes by car. For most of the population, or almost 99 percent, the nearest pharmacy is less than 20 minutes away. 127,000 people, or roughly 1 percent of the population, have to travel for more than 20 minutes to reach their nearest pharmacy.

Growth Analysis has also analysed which places have both a healthcare centre and a pharmacy. The analyses have shown that there are 13 healthcare centres where the pharmacy is more than 20 minutes away by car.

Accessibility to non-prescription medicines has increased markedly since their sale became permissible outside of pharmacies. These retailers are well dispersed across the country, but close to half of them have been established in areas with a very high accessibility to localities. Just over 4 percent of the new retailers selling non-prescription medicines have been established in areas with low or very low accessibility to localities.

Approximately 68,000 people now have to travel further to their nearest retailer of non-prescription medicines (OTC - Over-the-counter), despite the significant increase in the number of retailers. This change is a result of pharmacy representatives leaving the areas concerned and no new OTC retailers being established in the local area. The development is therefore probably independent of the pharmacy regulations.

The number of pharmacy representatives has fallen both in recent years and over a longer period. Since 1999, the number of representatives has fallen from 963 to 737, a reduction of over 226 representatives or in relative terms close to 23 percent. Since 2009, the number of pharmacy representatives has fallen by 102 or roughly 12 percent. All types of areas have been affected. There may be a number of reasons for the decline, for example that a number of pharmacy representatives may have disappeared because the representative's main operation, e.g. convenience store, has closed, and some pharmacy representatives may also have discontinued their service for other reasons. There is nothing to indicate that a representative has disappeared at Apoteket AB's initiative.

The pharmacy representatives have great significance for accessibility to medicines, especially in sparsely populated and rural areas where it is a long way to the nearest pharmacy and where there may be no other retailers of non-prescription medicines.

With the exception of Kronans Droghandel, the private chains have a stronger profile in areas with very high accessibility to localities than Apoteket AB. Apoteket Hjärtat and Kronans Droghandel are the only players to have pharmacies in all index classes. Apoteket AB has retained roughly the same geographical location pattern in relative terms between 2009 and 2012.

In May 2012, there were some 10 players offering distance selling of prescription medicines for people. The scope and structure of the distance selling varies widely between the players. Sales of pharmaceuticals through distance selling is still relatively marginal but many players say that they wish to offer their customers distance selling some time in the future.

Geographical accessibility to pharmaceutical – An analysis of the deregulation of the pharmacy market – Final Report

Serial number: Report 2012:11

Reference number: 2010/220